In my last post I talked about our goal of paying off our

house in 7 years. That seems like a crazy, unrealistic idea to some people. To

us it sounds hard, but not impossible. But why? Why do we so badly want to get

out from under our loan? Here are our top 3 reasons for wanting to pay off our

house as quickly as possible.

1. Debt is serious

The Bible doesn’t say it’s a sin to borrow

money. It also doesn’t say that it’s a wonderfully awesome thing, either. Scripture

does, however, give some pretty heavy warnings about where debt can lead and how

to properly handle money owed. Proverbs 22:7 says that the borrower is slave to

the lender. I don’t know about you, but I’m not a huge fan of making myself a

slave to anyone but God. Debt, in a very real way, enslaves you as you are bound to repay that

money with compounding interest. This ties you up and has brought many people

to more than just financial ruin. Psalm 37:21 says that the wicked borrow and

do not repay, so we know that once we get into debt we are obligated to repay

our loan. Along that note, Ecclesiastes 5:4 tells us that it is better not to

make a vow than to make one and not fulfill it (such as getting into debt and

then having to foreclose). God never says you cannot get into debt, but He does

warn that it is a heavy burden and that, as Christians, we are obligated to

repay our debts honestly. When we get in over our heads with debts too large to

repay, we bring ourselves financial ruin and a poor name to the Body of Christ.

2. Good stewardship means not wasting money

We should all be good stewards of our

money. To us, that means not spending more than necessary so that we can put

our finances to the best possible use. Instead of supporting a corporation with

interest dollars, we’d rather put that extra money toward helping others adopt,

supporting missionaries, and assisting people in crisis.

With interest, our $126,300 loan would

explode into paying the bank $233,768.96 over the course of a 30 year term.

That’s $98,768.96 more than we “bought” the house for. In other words, if we

pay on schedule we will pay 73.16% more than what the house is currently worth.

That’s quite a markup.

To put things in perspective I downloaded a

free app called “Payoff Track” which allows you to customize the numbers and

see how much you can save by making extra payments on your loan. You can even

track multiple loans at once if you want.

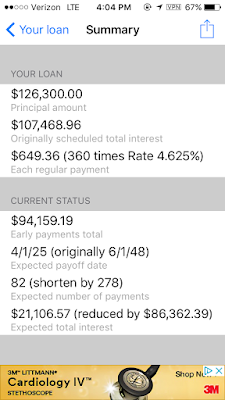

I inserted the data: A loan of $126,300 at

an interest rate of 4.625% on a 30 year term, with the first payment being due

June 1, 2018. Our monthly payment, as you can see from the screen shot below,

is $649.36 (insurance and taxes brings our monthly house bill to $974.51).

Did you know that just by making double

payments you can pay off your 30 year loan in about 10 years? That doesn’t

quite meet our dream of a 7 year payoff, though, so we had to create some

bigger goals. If I click on “Payments” in the blue box I can adjust each month’s

payment by what we expect to actually pay on the loan. We are aiming to pay an extra

$708.71 each month, which is simply what we worked into our budget to be able

to afford. That’s our goal, of course, based on a “good month” and barring any national

emergencies.

The app makes it easy to calculate extra

payments. I clicked on “Batch” in the upper right hand corner and set it up to

automatically add that extra money into the monthly payment. This brings our

monthly batch payment on the principle and interest to $1358.07.

If I remember correctly, that brought our

payoff date to somewhere around 9 years from now. Great! But still not good

enough to meet our goal. We went in and added an extra $5,000 to every April

payment. Where is that extra $5,000 coming from? Hopefully a chunk of it will

come from our tax return and we’ll be able to make up the rest of it with

savings along the way. Hopes and dreams. Not necessarily reality, but this is

our Grownup Dream, remember? These are pretend numbers we’re playing with.

If I go back to the home screen and click

on “Summary” in the blue box, I can get a quick rundown of how we’re doing, and

our scheduled payoff date. We are hoping to put an extra $2,926.58 toward our

first payment due in June (in the next post I’ll tell you how part of that

money came about). In addition to that large first payment of $4,225.30, by

making an extra payment of $708.71 each month, and theoretically being able to

pay an extra $5,000 on top of that every April for the next 7 years, we can

have our house paid off by April 1, 2025. Woohooo!!! See, that dream is not so

unrealistic after all, right??! Yeah, yeah, I hear your eyes rolling. It’s a

stretch, and we know we won’t be able to meet that goal every single month. But

it doesn’t seem so very far out of reach after all.

Let’s take a closer look at that “Summary”

page. If we really can reach our monthly and yearly goals, then we will have

shortened our payoff date by 23 years. Right. Duh. Okay, but let’s look at the

financial numbers. Under “Current Status” it tells me that we will have made

$94,159.19 worth of extra payments. This means we will have made only 82

payments, shortening our loan by 278 payments. And here’s the kicker. We will

have paid only $21,106.57 in interest, rather than the $107,468.96 we are scheduled

to pay. That means, in the long run, our loan will cost a total of $147,406.57

instead of $233,768.96. That’s a savings of $86,362.39. What can YOU do with an

extra eighty-six-thousand-three-hundred-sixty-two-dollars-and-thirty-nine-cents?

If we don’t have to pay that much more, isn’t

it a waste to do so? For us, good stewardship means *if possible* putting that

$86,362.39 into something far more meaningful than financially supporting a

bank. Which brings us to our third and most exciting point.

3. The sooner we get out of debt, the more we

can help others

If we can get out of debt, we will have

more resources to help more people. We are all responsible for helping others

no matter what our personal finances look like, but if we do not owe a huge

amount to the bank every month, we will have that much more to offer others in

need. After receiving so much help from others, we’re pretty excited about

paying it forward!

Secondly, we can get off support and

thereby support more preachers. Don’t get me wrong, we are incredibly grateful

to our supporters who make it possible to minister in Wisconsin. It’s thanks to

them that Joshua only has to work a part-time secular job and is able to focus

so much of his attention on preaching and evangelism. But we don’t feel like we

should plan to rely on this support forever.

If we didn’t have to make a monthly house

payment of $649.26 we would have an extra $7,792.32 a year. With the financial

support we receive from the congregation Joshua preaches for, plus his job as a

bus driver, we would not have to rely on outside support to continue preaching

here.

There is absolutely nothing wrong with

living on support from Christians in other areas. There are biblical examples of

doing so (see such passages as Philippians 4:10-20). However, if we can work

toward getting off support, the finances we currently receive will be freed up for

our supporters to help other Christians. Missionaries and preachers in other

areas can receive help from the Christians who currently support us, and the

Gospel can be spread further. And that is a motivating reason to get out of

debt.

No comments:

Post a Comment